50+ what percent of your income should go to mortgage

Web Lenders often use the 2836 rule as a sign of a healthy DTImeaning you wont spend more than 28 of your gross monthly income on mortgage payments and no more than 36 of your income on total debt payments including a mortgage student loans car loans and credit card debt. Web The 2836 rule is a good benchmark.

What Percentage Of Income Should Go To Mortgage

When determining what percentage of income should go to mortgage a mortgage broker will typically follow the 2836 RuleThe Rule states that a household should not spend more than 28 percent of its gross.

. However many lenders let borrowers exceed 30 and some even let borrowers exceed. Web Once a potential home buyer has taken the time to examine their personal finances and established how much house they can afford by using the 2836 ratio that lenders recommend it will easier to determine what a monthly mortgage payment will be. Web While up to 75 percent of your income typically goes toward basic living expenses the other 25 percent is divided among other miscellaneous expenses.

Web Web Many lenders and mortgage experts adhere to the 28 limit meaning your monthly mortgage repayments should not exceed 28 of your gross monthly income or. Keep your total monthly debts including your mortgage payment at 36 of your gross monthly income or lower. And you should make sure that you dont go over 36 of gross.

Keep your total debt payments at or below 40 of your pretax monthly income. So for example if your monthly income after taxes is 6000 youd multiple this by 25 to get the maximum amount you should be putting toward your mortgage. No more than 28 of a buyers pretax monthly income should go toward housing costs and no more than 36 should go toward housing costs plus monthly.

But some borrowers should set their personal level higher or lower. While its suggested that up to 28 of. Web Lenders usually dont want you to spend more than 31 to 36 of your monthly income on principal interest property taxes and insurance.

However there are multiple factors to consider when budgeting to buy a home. Keep your mortgage payment at 28 of your gross monthly income or lower. Web Finally the 25 post-tax model says that your total monthly debt should be 25 or less of your monthly post-tax income.

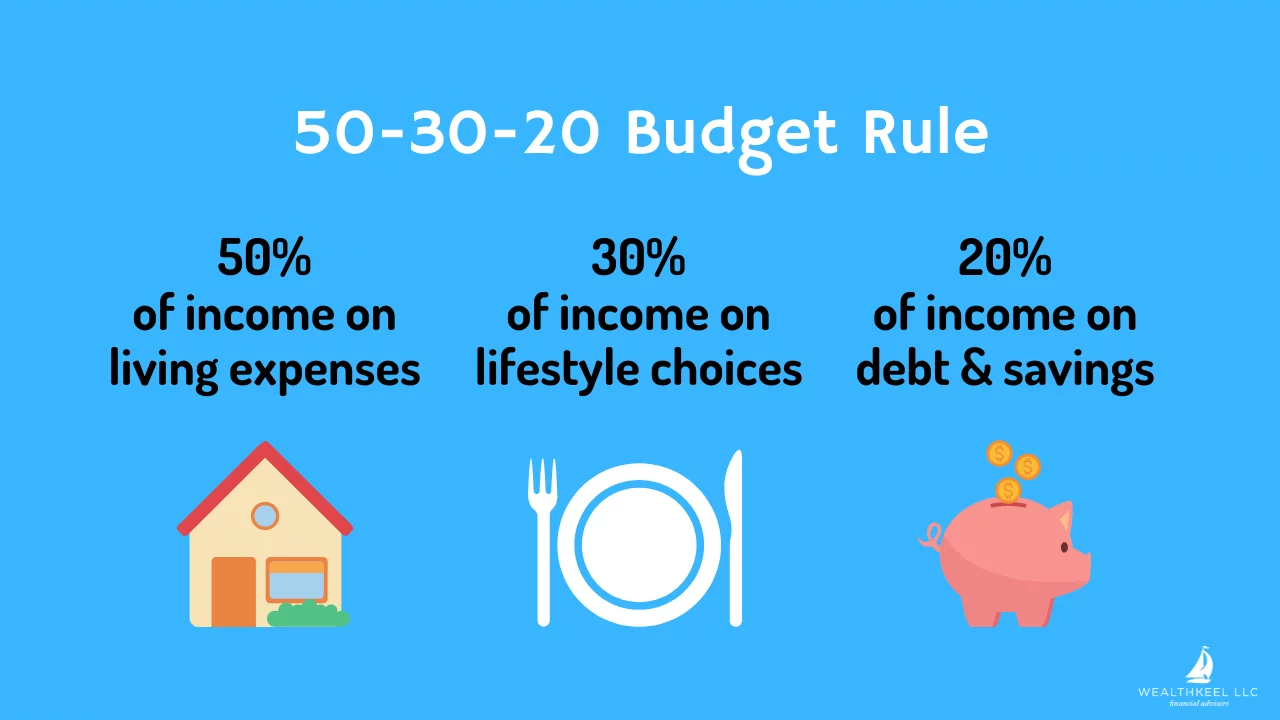

Web The 28 mortgage rule states that you should spend 28 or less of your monthly gross income on your mortgage payment eg principal interest taxes and insurance. 50 of net pay for needs 30 for wants and 20 for savings and debt repayment. Web The 28 mortgage rule states that you should spend 28 or less of your monthly gross income on your mortgage payment eg principal interest taxes and insurance.

Web Using a mortgage-to-income ratio no more than 28 of your gross income should go toward your mortgage paymentincluding principal interest tax and insurance payments. Note that 40 should be a maximum. Web The often-referenced 28 rule says that you shouldnt spend more than that percentage of your monthly gross income on your mortgage payment including property taxes and insurance.

To determine how much you can afford using this rule multiply your monthly gross income by 28. Web A general rule of thumb for homebuyers is your home loan should eat up no more than 28 of your pre-tax monthly income. Other mortgage-to-income budgeting considerations.

Note that 40 should be a maximum. Web As the name suggests this rule states that no more than 28 percent of your gross income should go toward your monthly mortgage payment. Web The most common rule of thumb to determine how much you can afford to spend on housing is that it should be no more than 30 of your gross monthly income which is your total income.

This percentage also puts you below the mortgage stress threshold of 30. Mutual of Omaha Mortgage offers a mortgage calculator to assist home buyers with an. Aim to keep your total debt payments at or below 40 of your pretax monthly income.

This 28 is often referred to as a safe mortgage-to-income ratio or a good general guideline for mortgage payments. We recommend an even better goal is to keep total debt to a third or 33. Web Some experts suggest that the total amount you pay towards your mortgage should not exceed 28 of your gross rather than net income.

Web Our 503020 calculator divides your take-home income into suggested spending in three categories. Web To determine how much income should be put toward a monthly mortgage payment there are several rules and formulas you can use but the most popular is the 28 rule which states that no more than 28 of your gross monthly income should be spent on housing costs. For example if you make 10000 every month multiply 10000 by 028 to get.

Web The 2836 rule is an addendum to the 28 rule. You can plug these numbers plus your estimated down payment. 28 of your income will go to your mortgage payment and 36 to all your other household debt.

Below well help you figure out how much you can afford and well also tell you the affordability rules lenders require for different types of mortgages. Web As a general rule of thumb your monthly housing payment should not exceed 28 percent of your income before taxes. I recommend striving to keep total debt to a third of your pretax income or 33.

Web With this method no more than 36 percent of your gross monthly income should be allocated to your debt including your mortgage and other obligations like auto or student loans and. This calculation is often referred to as the front-end ratio. So if your gross monthly income is 8000 your monthly mortgage payment should not exceed 2240.

Web A good rule of thumb is that the front-end ratio based on PITI should not exceed 28 of your gross income. If your monthly debts are pretty small you can use the 28 rule as a guide. Web Keep your mortgage payment at 28 of your gross monthly income or lower.

Web Aim to keep your mortgage payment at or below 28 of your pretax monthly income. Web Web In total your PITI should be less than 28 percent of your gross monthly income according to Sethi. Lets say your total monthly income is 7000.

Web Many lenders and mortgage experts adhere to the 28 limit meaning your monthly mortgage repayments should not exceed 28 of your gross monthly income or the amount you earn before taxes are deducted. This includes credit cards car loans. Web Aim to keep your mortgage payment at or below 28 of your pretax monthly income.

Web Generally speaking no more than 25 to 28 of your monthly income should go toward your mortgage payment according to Freddie Mac.

Smart Money Tips For Anyone Age 50 Or Older Part 1 Delta Community Credit Union

How Much Do I Need To Retire As A Physician Wealthkeel

How Much Money To Have Saved By Age 50

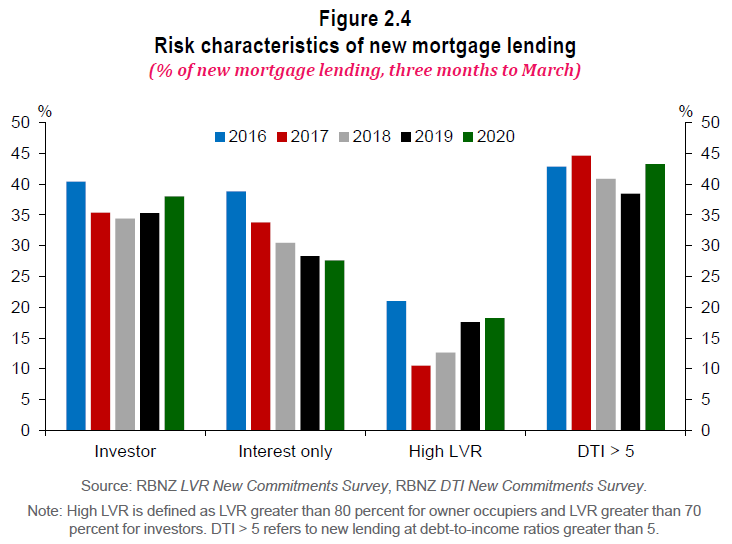

Rbnz Analyses Housing Negative Equity Risks Interest Co Nz

Income To Mortgage Ratio What Should Yours Be Moneyunder30

How To Create A Profitable Second Act Career

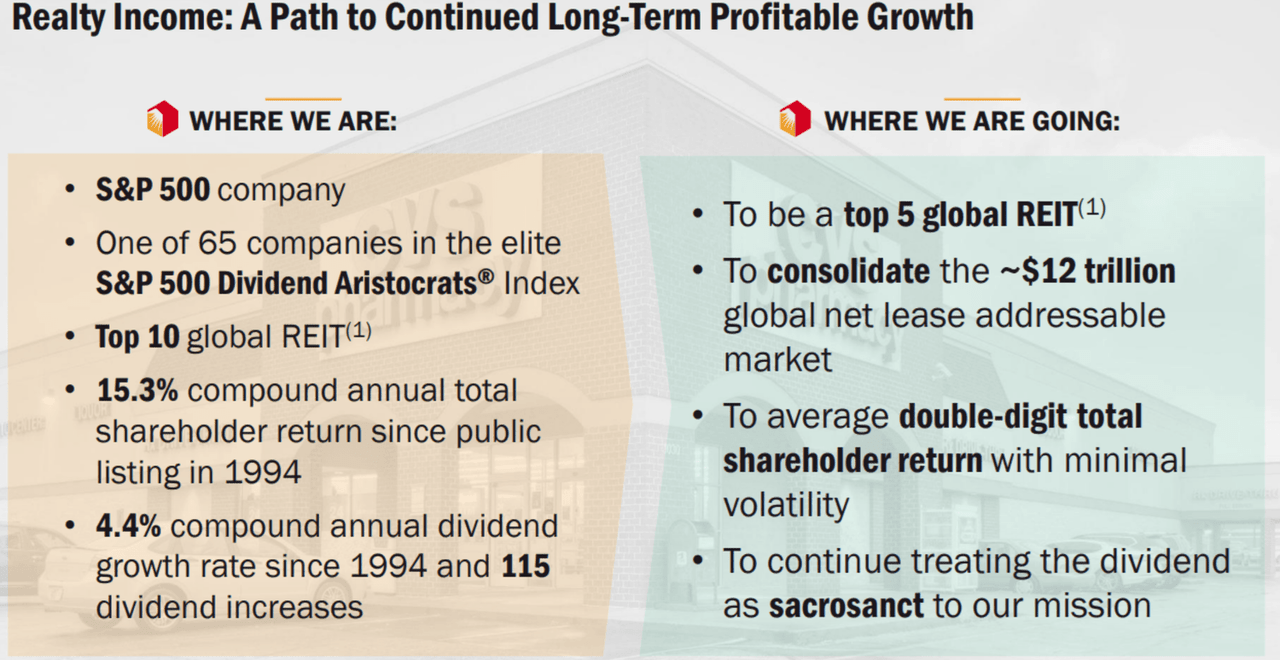

Realty Income O 50 Big Dividend Reits Compared Seeking Alpha

The Most Welcoming Jobs For Over 50s In 2022 And How Much They Pay

The Most Common Multiple Income Streams

:max_bytes(150000):strip_icc()/one-income-two-people-2000-6da83e67f96a4e5583697998af94f9eb.jpg)

How And Why To Live On One Income In A Two Income Household

How Do You Manage Your Finances With Your S O R Marriage

How Much Of My Income Should Go Towards A Mortgage Payment

Fafsa Basics Parent Assets The College Financial Lady

What Percentage Of Your Income To Spend On A Mortgage

What Percentage Of Income Should Go To Mortgage

50 Personal Budgeting Tips To Keep You On Track Debt Com

What Percentage Of Annual Income Should Go To Rent